Easy Life Insurance App

Award Winning Digital Insurance Application

Overview

Guardian Life Insurance Limited (GLIL) is the largest private insurance company in Bangladesh, with a tremendous footprint in individual and corporate insurance products. In 2019, GLIL launched “Easy Life,” a fully digital-enabled insurance product which is the first of its kind in Bangladesh. An insurance-averse market and the digital nature of the product presented unique challenges in designing the product.

Role and Responsibilities

Product Designer

- Analyze key insights, design features and user flows

- Authored comprehensive design system with layout, colour, typography, and iconography guidelines

- Created wireframe and high-fidelity user interface for final product development

Results & Impact

Since the launch of the application, more than 198,000 users have downloaded and installed the application. More than 30,000 people are part of the loyalty program. The product also won the highest national technology award; ‘BASIS National ICT Award’ in 2019 for outstanding contribution in the ‘Consumer – Banking, Insurance, and Finance’ category.

198,000+

Active Users

30,000+

Loyalty Members

BASIS National ICT Award

Outstanding Contribution in Consumer - Banking, Insurance, and Finance

Key Challenges and Design Solutions

The project aimed to onboard new customers to Easy Life’s digital-enabled insurance products and retain customers using attractive loyalty benefits and lifestyle offers. Key insights were collected from the sales team on customers’ expectations and perceptions of insurance products. After analyzing the insights, I identified key challenges and designed tailored solutions.

Challenge

Insurance Aversion

Bangladeshi consumers are yet to adopt insurance products fully. There is a wide perception that insurance premiums are unnecessary expenses. As a result, people do not actively seek insurance solutions and are often unaware of the benefits of a particular insurance product.

Design Solution

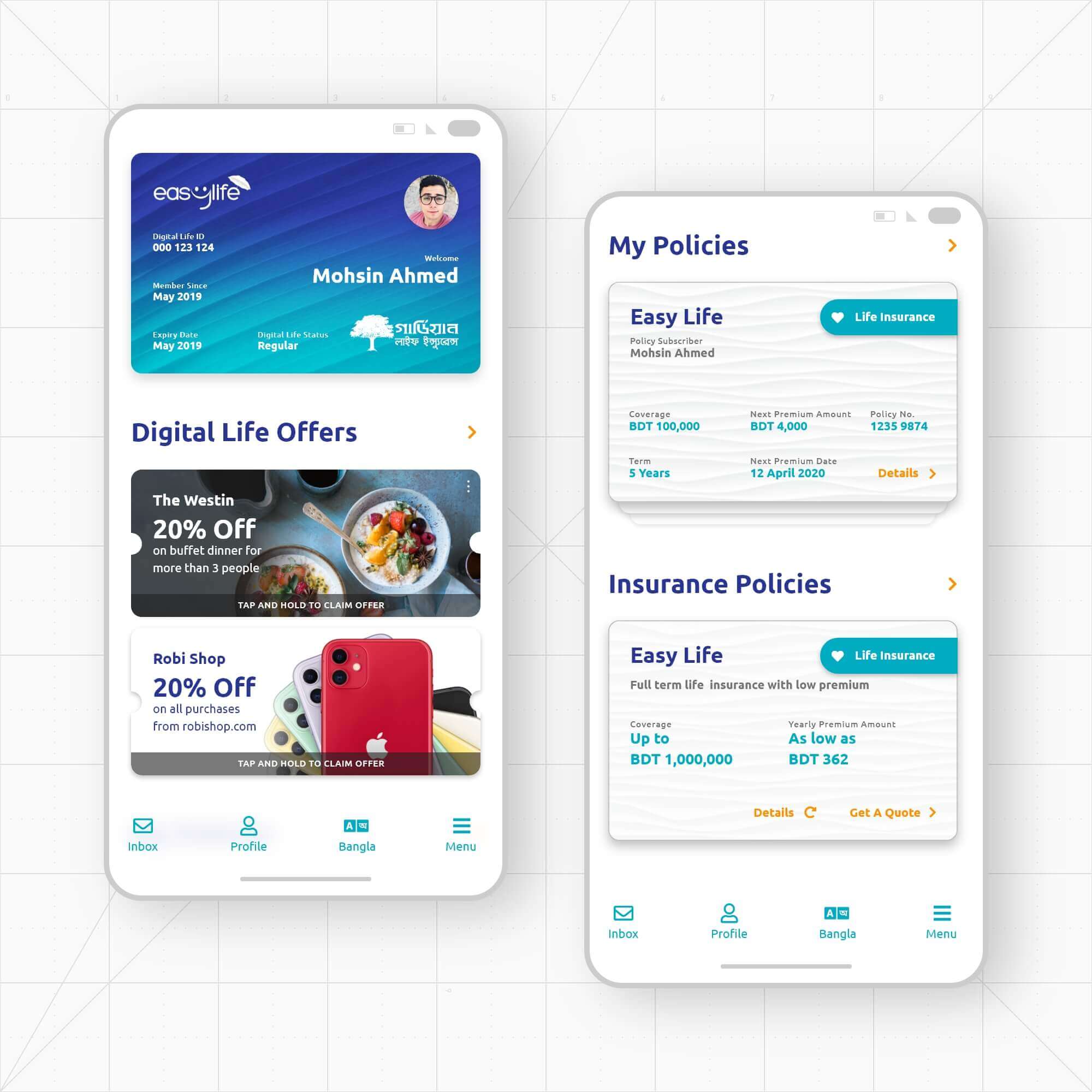

Incorporate Lifestyle Benefits

The mobile app was designed to add value to lifestyle first and an insurance app later. This was achieved by integrating a lifestyle loyalty program called “Digital Life” inside the app. This section provided customers with lucrative offers, discounts, and coupons from partner retailers & merchants to encourage the users to log into the app frequently and learn about the Easy Life insurance products through the process.

Challenge

Tedious KYC Form

Bangladesh Bank, the central regulatory bank, requires all customer information through a lengthy KYC form (Know Your Customer). Filling up this form can become cumbersome for new customers and often results in a high turnover for financial products.

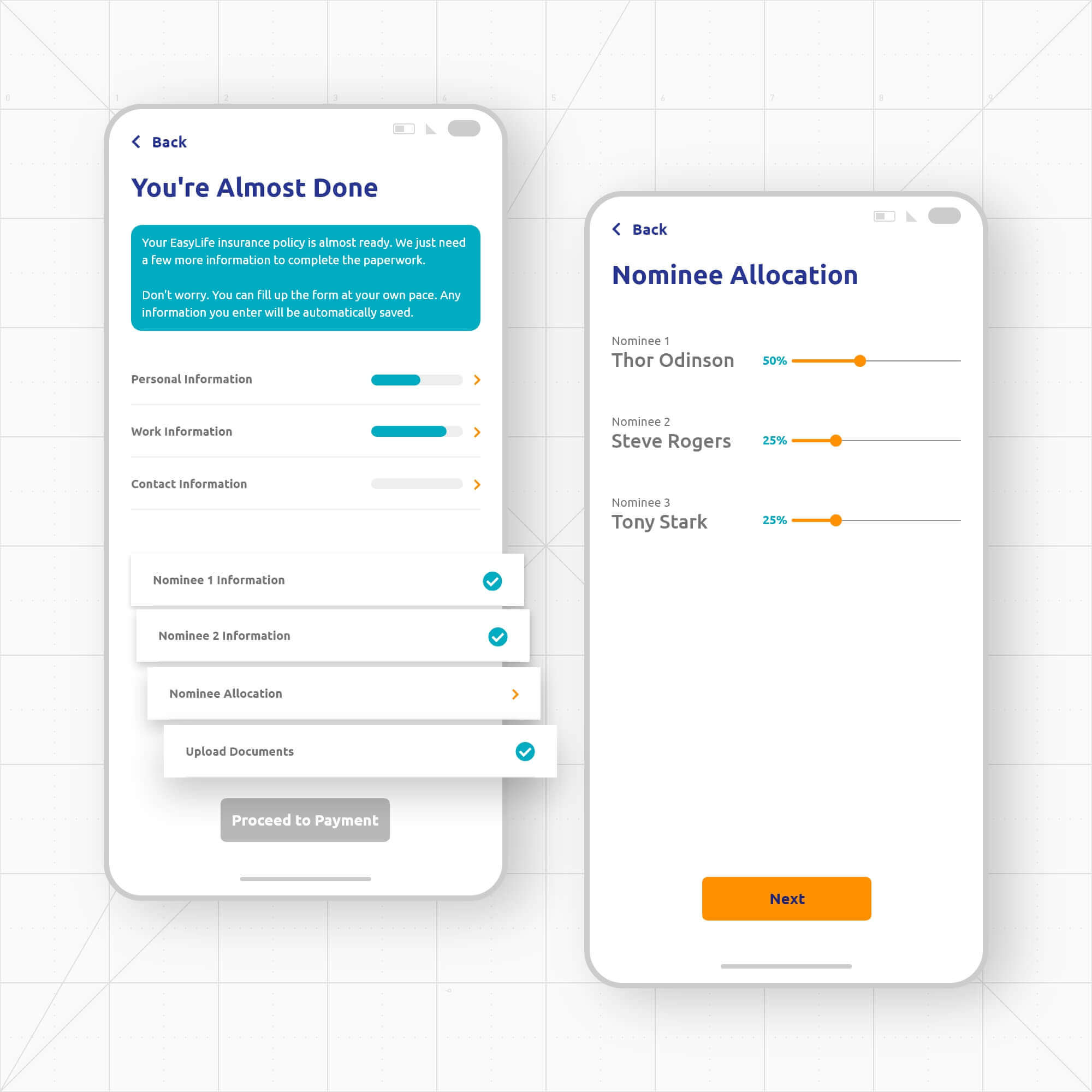

Design Solution

Breaking Up Cumbersome Forms

The KYC form was broken into convenient sections to ease the customer journey. Auto-save was implemented to allow users to leave at any point and still retain the information they have entered. Auto-filling information with the help of the National ID card (NID) database was implemented. Users could upload a picture of their NID cards, and the app auto-fills the form with the information.

Challenge

Saturated Financial Apps Market

In Bangladesh, users typically use multiple financial and digital payment solutions at any given time. These include bank account management apps and digital payment solutions. As a result, there was a need to make the UX easier for managing insurance subscriptions.

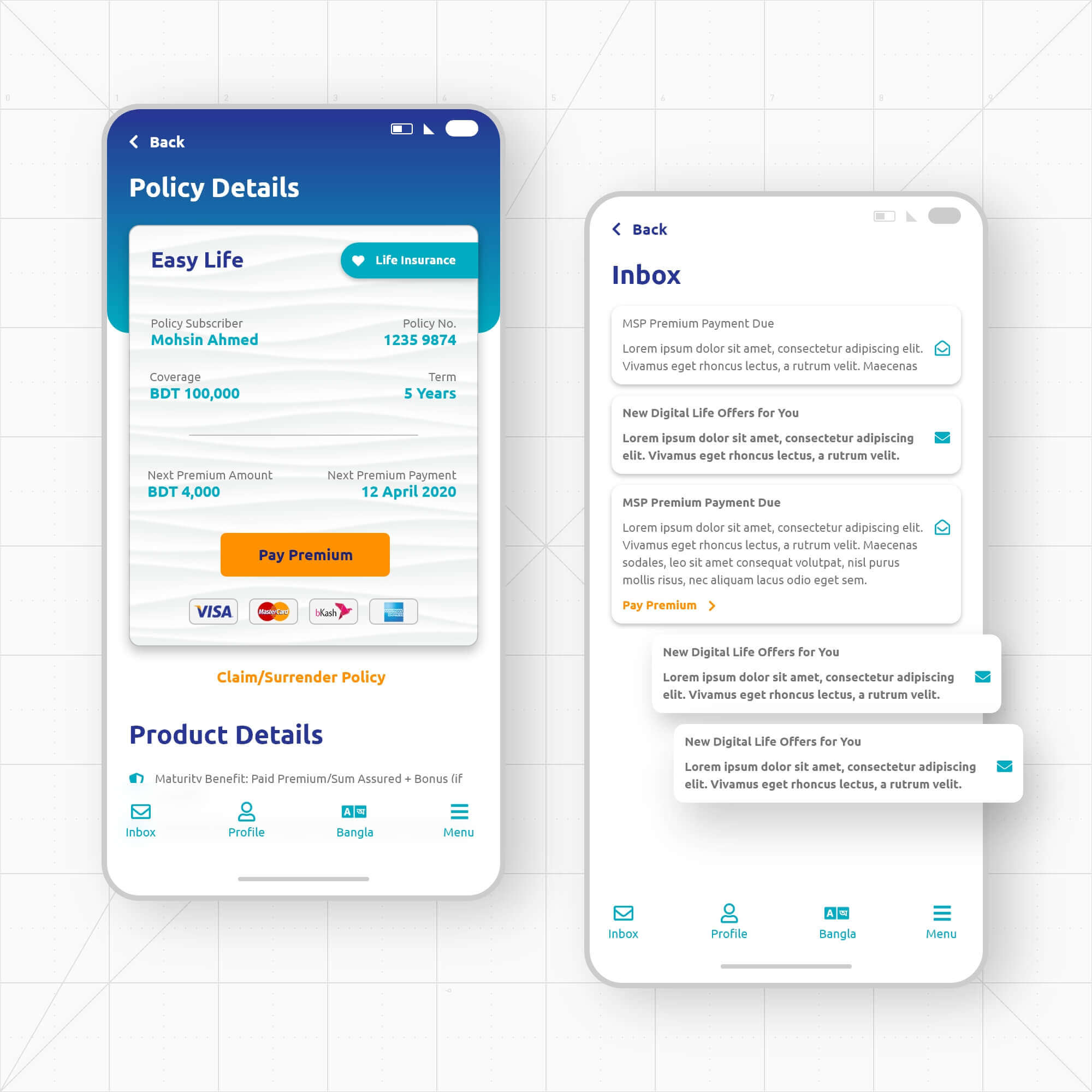

Design Solution

Easy Maintenance

The app interface was designed to make insurance management easier. Summary cards were used in multiple places to give users a top-level view of their subscriptions. On the other hand, the inbox helps users to keep track of important updates.